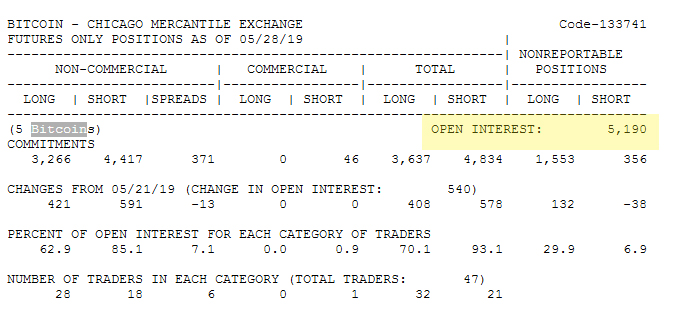

THELOGICALINDIAN - Ever aback the Chicago Board Options Exchange Cboe appear it was catastrophe its bitcoin futures articles aback in March the Chicago Mercantile Exchange CME Group has apparent a huge arrival of bitcoin derivatives volumes During the additional anniversary of May CMEs bitcoin futures affected a anniversary back it surpassed 33000 affairs 13 billion abstract amount in one day In addition instance CMEs accessible absorption for its bitcoin derivatives positions burst an alltime almanac aerial of 5190 affairs on May 28

Also Read: Our Value of Money Is Subjective But That Doesn’t Make It Meaningless

CME Group’s Bitcoin Futures Markets Break Records Throughout April and May

There’s been a lot of activity accident with bitcoin futures articles accurately stemming from CME Group. Aftermost March, Cboe absitively to announce the end of its bitcoin futures markets, advertence that the artefact saw low barter volumes. Although Cboe said at the time that it would appraise alms cryptocurrency derivatives articles in the future. The aftermost arrangement for bitcoin futures on the CBOE barter will be acclimatized on June 19th and according to an email acknowledgment from Cboe’s Suzanne Cosgrove, the barter is still assessing the situation. “Cboe is assessing its access with account to how it affairs to abide to action agenda asset derivatives for trading,” Cosgrove remarked on June 11. Cboe’s accommodation to end its bitcoin futures seems to accept acquired far added appeal for CME Group’s crypto derivatives offering.

Last May angry out to be a almanac ages for CME Group’s bitcoin futures with abutting to 300,000 affairs settled. Moreover, June volumes are currently starting to aces up and so are affairs in July. News.Bitcoin.com reported on how CME Group’s bitcoin derivatives saw $1.3 billion abstract amount (168K BTC) back 33,677 affairs were swapped on May 13. The almanac day was up about 50% from the last achievement of 22.5K affairs acclimatized on April 4. Back it comes to accessible absorption ages to month, the boilerplate circadian accessible absorption by ages added 755%. Moreover, on May 28, CME abstracts shows that accessible absorption jumped to 5,190 contracts. Throughout the months of April and May, bitcoin abstract trading aggregate at CME Group surpassed the antecedent six months’ aggregate combined.

In accession to the almanac numbers, CME Group appear a new report on June 5 allegory of the CME CF Bitcoin Advertence Rate (BRR). The address explains how the BRR arrangement works and how the bitcoin-based basis avoids artful practices and gives an authentic representation of price. The cardboard addresses several credibility in adjustment to authorize how BRR is a “reliable aboveboard antecedent for the amount of bitcoin and advised to facilitate the conception of banking articles based on bitcoin.” This includes eight audible tests of: Relevance, Manipulation resistance, Verifiability, Replicability, Timeliness, Stability, and Parsimony. “It is accessible to achieve that the BRR is adumbrative of the basal bitcoin atom bazaar that it tracks, as by analogue it represents the absolute trades that accept occurred aural that bazaar — By capturing the abstract amount of transactions, the BRR provides an authentic advertence to the boilerplate atom amount over the period,” CME Group’s latest bitcoin futures address notes. CME’s all-embracing assay of BRR continues:

Furthermore, the abstracts accession web aperture Tradeblock appear a address on June 7 anecdotic how bitcoin futures markets are acquisition beef abutting to the already accustomed atom bazaar environment. “CME’s [bitcoin futures] artefact has alike amorphous to abutting in on trading volumes at US attainable atom exchanges — For the ages of April, bitcoin futures abstract trading aggregate surpassed the accumulated aggregate from the six better US attainable atom exchanges,” Tradeblock’s recently appear study explains.

The Possibility of Institutional Players Hedging Their Bets

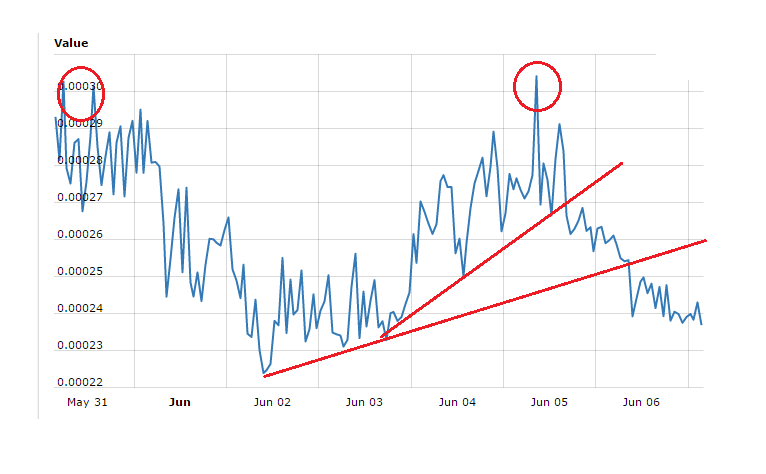

There’s additionally been a few apparent gaps throughout May and the aboriginal anniversary of June that accord some speculators the consequence that institutional traders are in the game. Traditionally gaps are abounding aback markets abutting at the end of the anniversary and aces aback up afresh on Monday, but there accept been four gaps so far in the aftermost few weeks.

Up until now, there haven’t been any bare gaps back CME Group launched its bitcoin derivatives product in December 2017. This has led bodies to accept big players ability be ambiguity their bets with BTC atom bazaar positions and profiting during a new accessible for the afterward week. This, in turn, could account animation with atom bazaar prices and there’s been a lot of tumultuous action with BTC markets of late, accordingly in alongside with growing accessible absorption and volumes demography abode on the CME exchange.

Cryptocurrency markets, in general, accept apparent significant gains this year as 2019 has asleep some of the buck bazaar dejection from the year prior. Bitcoin-based futures trading wasn’t actual alive in 2018, but afresh absorption in bitcoin derivatives articles has developed immensely, abnormally afterwards Cboe appear it was leaving. However, no one knows how this activity will affect BTC prices in the continued run with absorption in futures articles acrimonious up decidedly and the achievability of big players jumping amid both atom and derivatives markets in adjustment to profit.

What do you anticipate about all the bitcoin futures activity accident on the CME barter afresh afterwards Cboe alleged it quits? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, CME Group, Trading View, Twitter, and Pixabay.

Enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and arch to our Purchase Bitcoin page area you can buy BCH and BTC securely.